Do you know what affects the stock market? It’s not just a bunch of rich people making bets on whether or not they think the price of a commodity will go up or down. It’s also the public’s perception of that commodity, which various factors can influence.

Public information is a broad term that refers to any piece of information regardless of its format. Generally, agencies announce any information in the form of general announcements, news, publications, social media announcements, videos, etc.

Since there is a large audience for such mediums, the impact of public information dissemination is critical for the state of the stock market. Hence, understanding the effect of general information sources is crucial for brokers who want to learn how to trade stock.

Impact of Unexpected Public Information

The public’s perception of a company can greatly impact its stock price. A company that does well in the eyes of the public will see a boost in its share price, while a company that does poorly will see a decline in its value. That’s because investors are more likely to invest in companies they trust and believe in, and they’re more likely to hold onto those stocks for longer periods.

Unexpected news can have extreme impacts on the stock exchange on either side. While this may seem good to some, it can negatively affect many companies and investors. For instance, a crisis in the Middle East typically results in price hikes for oil assets. One such instance is the US air strike on Baghdad in 2020 that led to a 3% rise in crude oil prices.

Similarly, droughts can adversely impact stock prices as their results directly impact investor sentiment. It prompts risk-taking behavior from investors, affecting the stock prices.

When the unexpected happens, investors are often caught off-guard and have to respond quickly. The news that a company has been acquired or is going bankrupt can send stocks soaring or plummeting.

How Social Media Information Affects the Stock Market

Social media has become the new battlefield for many industries. The stock market is no exception. If a company has a bad reputation on social media, it can affect the stock price. On the other hand, if a company has good customer service and is known for being environmentally friendly, it can also affect its stock price.

Springer

The more positive or negative information about a company, the more likely it will be for its stock price to rise or fall accordingly. Social media users can promote or demote stocks and single-handedly lead to the downfall of large industries and investors.

For instance, investors rely heavily on LinkedIn when researching a company for investments. It’s widely considered a trusted source, making it a critical element for the performance of different stocks.

Likewise, traders also use YouTube to learn and view stock trends. Traders can learn investment strategies, equity trading, and evaluation of different brokerage platforms. In addition, influential traders can share their opinions of various stocks directly affecting stock performance.

One classic example of social media’s impact is the announcement of Tesla’s CEO, Elon Musk, who aimed to buy Twitter Inc. Twitter stocks plunged by 22% due to this announcement.

Political News and Its Effects on Stock Market

To learn how to trade, you must keep a close eye on political events. Government announcements, new policies, and decisions significantly impact stock markets. Moreover, political actions regulate how companies should work, so it’s not surprising how they affect stock values.

Since news influences economic and business conditions, investors keep a close eye on industries that will directly affect them after any announcement. For example, when Donald Trump came to power, it dramatically improved the stock performance in the oil industry. That’s because Trump was more inclined towards conventional energy than solar and renewable energy resources.

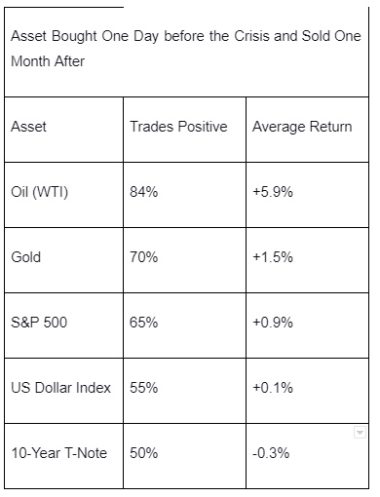

Political unrest disrupts the stock market. The following table shows how stock prices were affected before and after 20 crises in the Middle East over thirty years.

News Anticipation

Anticipation is one of the basic skills traders develop while learning how to trade. It is a state of mind that helps you stay ahead of the game and make educated guesses about what will happen next. It gives you an edge over other traders and allows you to make better decisions. Typically, traders use multiple resources to anticipate such public information. These sources include:

- Business Gossip – This is where traders get information from trusted sources about upcoming events or changes in the market that may affect the price of a particular security. These gossip may or may not have reliable information at their core.

- Industry News – Quarterly and annual company reports, leading indicators, and order histories indicate company performance and the industry’s possible state, thereby affecting stock values.

- Governmental Economic Reports – Government organizations’ employment reports indicate retailers’ confidence levels and possible outcomes.

Investopedia

Final Words

Public information is vital to the market. While rumors and speculation might get traders into trouble, solid, reliable public information can be used to make better trading decisions. So if you’re a trader looking to improve your performance, staying on top of the latest news, trends, and developments is important.